Condo Insurance in and around Claymont

Looking for great condo unitowners insurance in Claymont?

Cover your home, wisely

Condo Sweet Condo Starts With State Farm

Being a condo owner isn't always easy. You want to make sure your condo and personal property in it are protected in the event of some unexpected accident or damage. And you also want to be sure you have liability coverage in case someone becomes injured on your property.

Looking for great condo unitowners insurance in Claymont?

Cover your home, wisely

Condo Unitowners Insurance You Can Count On

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance is necessary for many reasons. It protects both your condo and your valuable possessions. In the event of a burglary or a tornado, you may have damage to some of your belongings on top of damage to the townhouse itself. Without insurance to cover your possessions, you might not be able to replace your valuables. Some of the things you own can be protected from theft or loss even when they are outside of your condo. If your car is stolen with your computer inside it, a condo insurance policy could cover the cost.

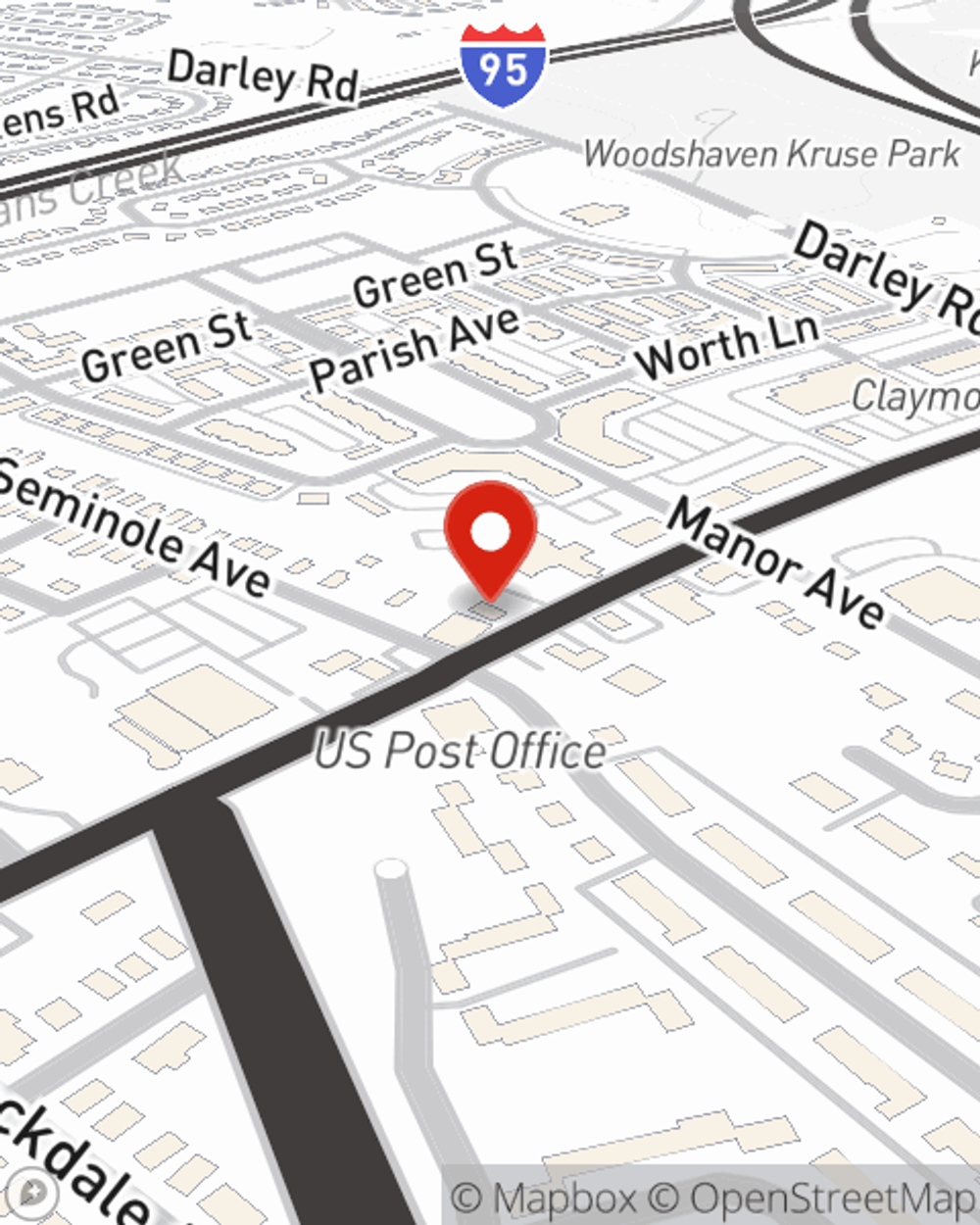

Fantastic coverage like this is why Claymont condo unitowners choose State Farm insurance. State Farm Agent Ron Cephas can help offer options for the level of coverage you have in mind. If troubles like wind and hail damage, identity theft or drain backups find you, Agent Ron Cephas can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Ron at (302) 792-9277 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.